Introduction

In the world of finance and investing, the adage “Don’t put all your eggs in one basket” holds true. Diversification is a fundamental strategy that investors employ to spread risk and build a resilient investment portfolio. By allocating investments across a variety of assets, industries, and regions, diversification aims to minimize the impact of market volatility and fluctuations, ultimately enhancing the potential for long-term returns. In this article, we will explore the concept of diversification, its importance, and how it can be effectively implemented to achieve financial goals and safeguard investments.

Understanding Diversification

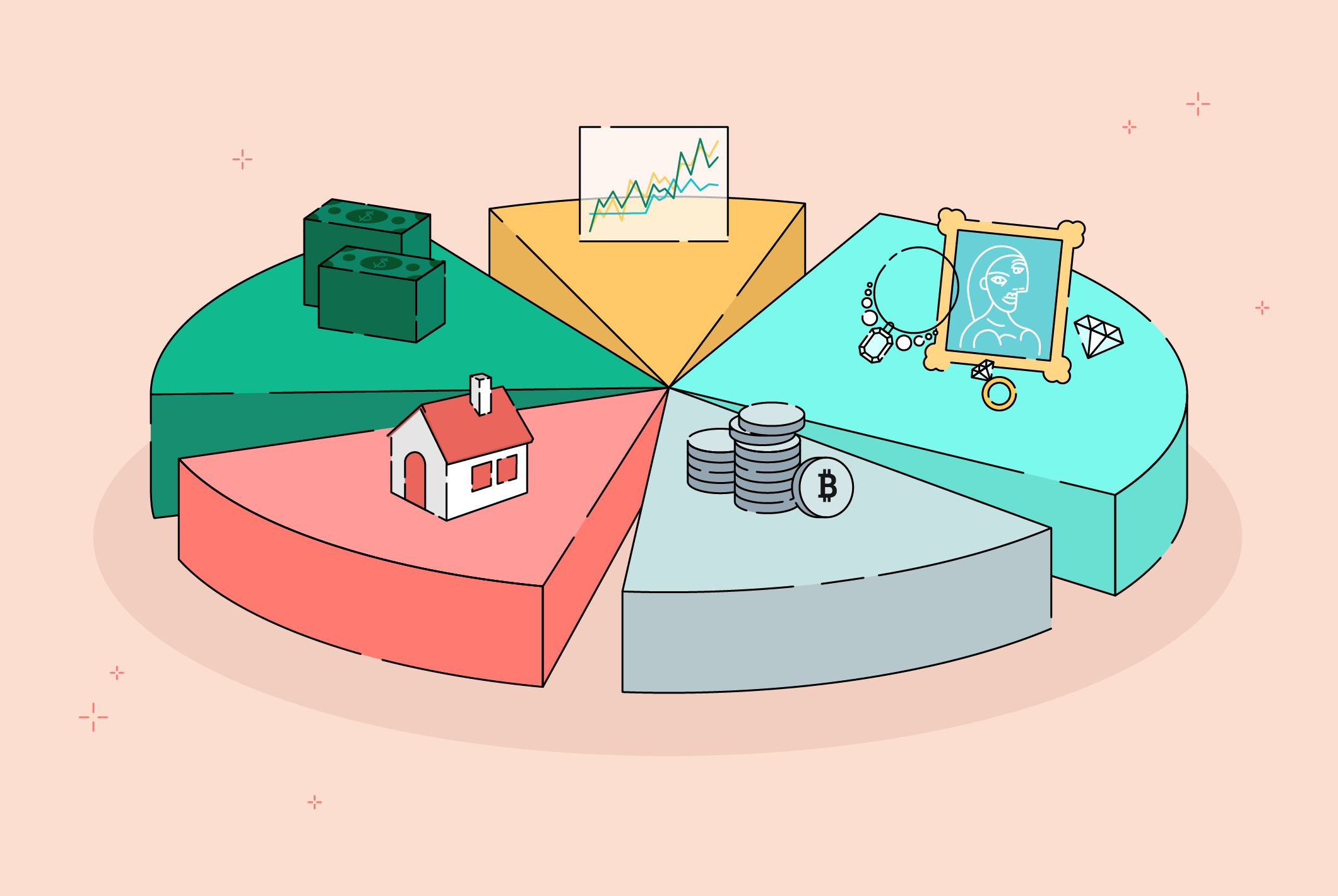

Diversification is a risk management technique that involves spreading investments across different asset classes and securities. The primary goal is to reduce the impact of adverse events that may disproportionately affect a single investment or a concentrated group of assets. By diversifying, investors aim to lower the correlation between their investments, as assets may react differently to various economic and market conditions.

The premise of diversification is based on the principle that not all investments will perform well simultaneously. While some assets may experience gains, others may face losses. By holding a diversified portfolio, investors increase their chances of capturing positive returns while limiting the potential downside risk.

Importance of Diversification

- Risk Reduction: Diversification helps mitigate the impact of individual asset volatility. When one asset underperforms, gains from other assets may offset the losses, reducing the overall portfolio risk.

- Smoother Returns: A diversified portfolio tends to exhibit smoother and more consistent returns over time, as the performance of individual assets balances out market fluctuations.

- Capital Preservation: By spreading investments across different asset classes, investors can protect their capital and prevent significant losses that might result from a concentrated investment strategy.

- Opportunity for Growth: Diversification allows investors to access a broader range of investment opportunities. It enables exposure to potentially high-growth assets while maintaining a balanced risk profile.

Implementing Diversification

- Asset Allocation: Determine the ideal allocation of assets based on your financial goals, risk tolerance, and investment horizon. Common asset classes include stocks, bonds, cash, real estate, and alternative investments like commodities or private equity.

- Geographic Diversification: Consider investing in assets across various regions and countries. Different economies perform differently at different times, and international exposure can reduce reliance on any single market.

- Sector Diversification: Allocate investments across different industry sectors. Each sector may respond differently to economic conditions, so diversification minimizes the impact of sector-specific risks.

- Rebalancing: Regularly review and rebalance your portfolio to maintain the desired asset allocation. Over time, some investments may outperform others, leading to imbalances that need correction.

- Professional Advice: Seeking advice from a financial advisor or investment professional can be valuable when developing a diversified portfolio tailored to your specific financial situation and goals.

Conclusion

Diversification is a cornerstone principle of prudent investing. By spreading risk across a variety of assets, industries, and regions, investors can build a portfolio that is better positioned to weather the storms of market volatility. While diversification does not guarantee profits or shield against all losses, it remains a powerful tool for managing risk and optimizing the potential for returns over the long term.

Investors should remember that diversification should be aligned with their individual financial goals, risk tolerance, and investment time horizon. With a well-thought-out and diversified investment strategy, individuals can navigate the unpredictable waters of the financial markets with greater confidence, aiming for sustainable growth and financial security.